Webinar

Alumni Ventures’ Fall RIA Educational Series

Part 1: Exploring the Benefits of Venture In Wealth Management Portfolios

In the first part of AV’s introductory VC series for the wealth management community, Head of Business Development Jack Barlow and Managing Partner David Shapiro will explore how wealth managers can benefit from incorporating venture capital in client portfolios.

See video policy below.

Post Webinar Summary

The speakers provide an overview of Alumni Ventures’ investment strategies, emphasizing their diversified approach, which spans sectors, stages, and geographies. They offer several solutions, including a core diversified model, a mid-stage follow-on strategy, and thematic programs for sector-specific exposure. They discuss the shift toward more investor-friendly valuations, noting that current market conditions present better entry points compared to the high valuations seen from 2018-2021. They operate both direct-to-investor and institutional private market funds. Alumni Ventures follows a generalist model but leverages deep expertise across sectors like health tech, AI, and fintech through both their internal team and a broad network of experts. The session concludes by encouraging attendees to engage in upcoming events focused on underwriting venture deals and market trends.

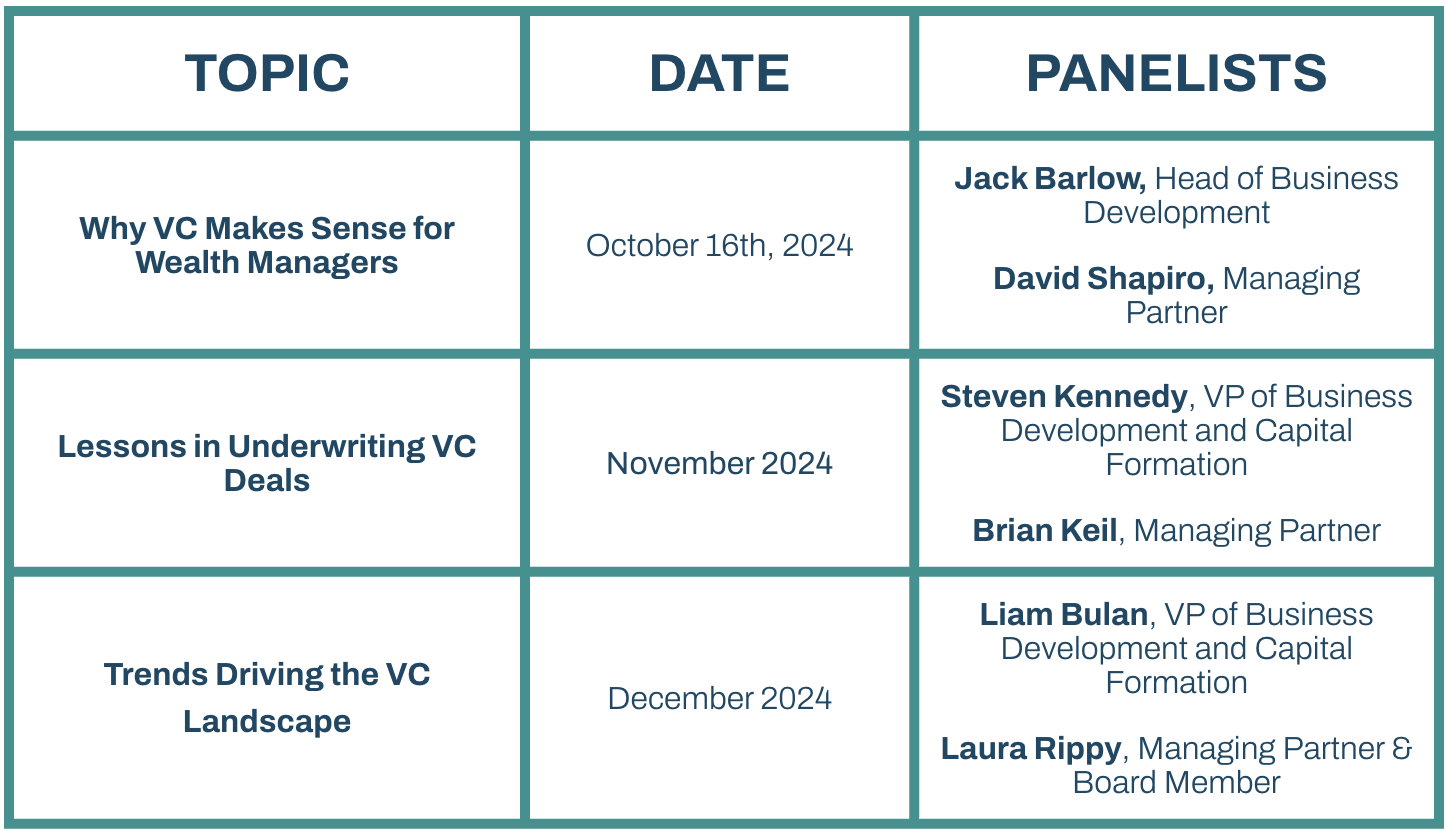

Alumni Ventures’ Fall RIA Educational Series will provide wealth managers with foundational, current knowledge on venture capital. Each webinar will build upon prior sessions—covering the following topics:

Contact [email protected] for additional information. To see additional risk factors and investment considerations, visit av-funds.com/disclosures.

Frequently Asked Questions

FAQ

Speaker 1:

The qualitative side is that adding venture can also provide advisors and the investors benefits beyond the portfolio performance piece. Many—in some of our conversations with organizations, like with you on the phone—many of the investors have interest in the general growth of the innovation economy. They are former executives themselves, their investors are investors—investors in new technology trends. They want to be aware of products and services and how that might be changing industry dynamics, whether it’s their own companies or just the general interest.

It also allows and enables these advisors to have differentiated solution sets. The world has certainly evolved past traditional stocks and bonds and mutual funds and ETFs, and the growing list of open-ended alternative investment funds. Adding some of these newer alternative solutions—venture being one of them—newer to the wealth management space, not necessarily newer to the investing universe, but certainly newer to the wealth management space, can help differentiate your solution to your clients.

And lastly, like all private equity and private market solutions, venture is a long-term asset class. And this allows you to build long-term relationships with your clients. You can work through the planning process and work through the portfolio growth process and building value and building those long-term relationships that we think venture can play a role in. And we would certainly like to be your partner to help deliver that solution.

We are, as we talked about, a venture asset manager. We come to the wealth community. We think we have great solutions, but we know it begins with education. We build a lot of our effort to support our wealth management partners that we work with around understanding our asset class, understanding our approach, and understanding how we drive value through education. We have many events that we structure around our growing community, which provides access to our portfolio companies, to our investment professionals, our thought, our thinking around where the opportunities are.

And then we do a number of events where we like to bring in our partners—both our direct investors and others—to get to know us directly and meet with the other members of the team, and then also meet with our portfolio companies.

We have a handful of ways that we could work with you if you are interested. We have a core diversified solution that covers—sort of as David outlined—our approach across the different sectors and entry points of venture. We have more of a mid-stage follow-on strategy, and we have a variety of thematic programs if you wanted to get a specific industry or sector exposure of interest.

That sort of concludes our direct remarks. We did get a couple questions. Certainly the chat box is open, but I’m just going to look in the box. I see three that we can address, and if others come up, certainly we’ll address them here. But if you have any questions you’d like to ask not in this forum, we would certainly encourage you to reach out to us. You can contact us through [email protected] and we will certainly return back to you with any comments on this presentation or any other questions you might have.

The first question I’m going to push over to David—following the comments on where we are in the market. The question is on: where are we seeing valuations today from the peak of the ’21–’22 period to now? What’s been our experience with valuations with our portcos, and how are we seeing that in our underwriting?

Speaker 2:

Yeah, yeah, good question. So thanks, Jack. Well, as I mentioned, I characterized the first point—and the way I’d characterize it—as much more investor-friendly. So we’re seeing lower valuations, lower entry points. We had a seed deal we were looking at—it was the first time in a while it was single digits as kind of the valuation in terms of what’s a pre-money—and hadn’t seen that in a long time, a bunch of years. So I call that—that’s helpful, right? It’s right-sized, a little bit more normative.

The businesses are as sound as ever. So it’s not really like we’re taking undue risk or anything with these businesses. It’s just more reasonable terms, more reasonable valuation. It’s really—there’s a pendulum in this market, and it swings. I’ll just describe it—on one side is entrepreneur-friendly. On the other is investor-friendly. And for years it’s been on the entrepreneur-friendly side.

2018, 2019, 2020, 2021—everybody was being extra friendly with entrepreneurs. Multiple term sheets, higher valuations, etc. And that led to a bit of a bubble. But certainly less—I would call it less ideal governance, valuations that made sense. That swung back the other way—and it’s swung back rather rapidly, right?

So right now we’re still seeing very strong on the investor-friendly side. Harder to raise capital for companies. It’s okay. It’s more balanced. It’s more fair. Companies appreciate the capital, I think, longer. And in these markets—this is where those “recession babies,” while we’re not in a recession directly—these phases of venture capital form fantastic companies.

So we’re really excited about where the market is now—and where it’s been really for the past year—and where it is now and continuing.

Speaker 1:

Great. We have two questions. One is an investment question, one’s an operations—but I’ll take the operations question first, then I’ll send the one back over to you, David.

So the operations question is: Are our solutions…?

So the quick answer is no. Our solutions are traditional private market funds. Our direct-to-investor business operates slightly differently than our institutional business, but in both cases they are traditional private funds with 10-year lives, with extensions. We’d be happy to explain that in more detail if anyone wants to learn a little bit more about how either side of our business works—on the direct investor side, which is largely oriented towards accredited investors, and our institutional business.

And then on the other investment question—David, I’ll pass to you. I think we’ve addressed this a little bit, but it asks: How does AV invest in general? Are we sector specialists or are we generalists?

Speaker 2:

I suppose the answer is a bit of both, right?

So first, our model overall at Alumni Ventures—and with each of our funds, really setting aside the sector funds (and that’s what I’m going to come back to)—is a generalist model. We are looking to build diversified portfolios—and diversified across geography, sector, and stage, as well as lead investor.

So we’ll do, from one alumni fund, 25 deals or so—all with top-quartile venture firms on the boards, leading the rounds—but it can be different sectors. That’s by design. We want to make sure that we’re not taking sector risk on, or political risk, or geographical risk—by building a portfolio that doesn’t have those dynamics. So that leads us to be generalists as we build a portfolio.

That said, we all have various expertise that we can lean on and tap into for a little more depth around sectors.

Just as a quick example—I co-run the Health Tech Fund, right? For a long time now, for over a decade, I’ve been in the health tech investing space. And at my prior firm I did it almost exclusively for a few years. So healthcare IT, med tech, med devices—not so much life science—but all the rest. So a pretty deep area of expertise for me that I can tap into, for example, both in the deals we’re seeing for an alum fund but also related to health tech.

Similarly, we’ve got colleagues with really, really great depth on AI, or financial services/fintech, or other areas like that—deep tech in particular. So we can share notes. If we come across a very interesting AI deal or deep tech deal, I can run it by my colleagues and get their opinions and tap into the Alumni Ventures network.

We have 10,000 experts at least now across the network that we can tap into for diligence and expertise to augment what we’re seeing and thinking. So it’s kind of a combination of—we think about it as T-shaped, right?

All of us as investors should be T-shaped. We need to be broad and sort of generalists—we’re a co-investor. We need to understand the deal dynamics, the dynamics among the investors—new and old—what are the terms, what are the valuations, etc.? How does the round composition come together? But we also, of course, want to be the depth there in some sectors—whether that’s individual or across the board.

So across the team, we have great depth in addition to generally having that generalist model in our portfolio building. Hopefully that’s helpful. Happy to go into more detail.

Speaker 1:

I’ll do one final question to see if there are any questions that the group wants to ask, but those are the three that came through.

While we’re waiting, I will just remind those on this line—if you would like to continue this journey with us—we will do our next session, Lessons in Underwriting Venture Deals, in mid-November. I think it’s about literally a month from today or tomorrow. We’d welcome your participation in that, which will get into our views on the underwriting process. We’ll use some deal examples that we’ve done ourselves.

And then, as I mentioned, in December we’ll look a little bit more into the broad trends driving the market and influencing where we’re putting capital, as well as where we’re seeing other people move capital.

Not seeing any other questions pop up at the moment, so I will thank everyone that joined us. Appreciate you taking out part of your day to listen to us, and hopefully this provides some insights into the venture marketplace. As you think about your own portfolio needs for your clients, we think venture could be a great tool to add to your toolkit, and we’d be happy to explain more how we could help you do it.

With that, have a great afternoon.

About your presenters

Chief Business Development Officer

Jack has over 20y experience in the asset management industry mainly oriented around the development and distribution of traditional private and open-ended alternative investment solutions to the wealth management community. He has worked across all major financial intermediary channels, including global private banks, national brokerages, registered investment advisers, and independent broker/dealers. Most recently, he helped lead BlackRock’s effort to bring its private market franchise to wealth including the launch of four evergreen solutions covering private credit, private equity, and hedge fund strategies. Prior to BlackRock, Jack was one of the original members of Blackstone’s Private Wealth Solutions team where he co-led the national account effort. Earlier in his career, he held corporate positions with Bank of America’s Alternative Investment Group, FleetBoston Financial, and management consulting. Jack has an Economics degree from Hobart College and an MBA from University of Chicago’s Booth School of Business.

David has over 25 years of experience as an investor, adviser, and board member, with expertise across early- and late-stage venture capital. Before joining Blue Ivy, David was Senior VP of Corporate Development and Business Development for DataXu, a marketer-aligned data and analytics company. Prior to his time at DataXu, he was a Director with the global venture and private equity firm 3i, including board directorships with ten companies. He also worked in the private equity group at GE Asset Management, where he specialized in late-stage venture and growth capital opportunities. David received his BA in History from Yale in 1991 and an MBA from the Tuck School of Business at Dartmouth in 2000.