The Continuing Evolution of Sports Media

This report explores the dynamic landscape of sports broadcasting, tracing its growth from linear TV’s dominance to the advent of streaming and personalized content delivery. The article delves into the rise of media rights value, new entrants in sports broadcasting, and the shift in consumer preferences while highlighting innovative venture-backed companies transforming the space. The piece underscores the importance of sports as a lucrative media asset and the opportunities for startups to innovate in this evolving space.

Sports are the greatest form of entertainment. There is drama, intrigue, and human interest, with heroes and villains. Story arcs can last games, seasons, and entire careers, with massive culminating events that crown champions. These are dynamics that Hollywood producers can only dream of replicating.

This alchemy has also positioned sports as one of the most important entertainment genres to broadcasters. However, as media distribution dynamics shift away from exclusive ownership by linear TV, we believe there is an opportunity for new companies to create value in the sports media value chain. This piece will briefly look at some of the themes we believe will power the evolution of sports media and some of the venture companies innovating in these spaces.

If you’re interested in continuing the discussion, watch our webinar to learn more about the exciting world of sports media evolution.

See video policy below.

The Evolution of Sports Media

To understand the future of sports media, we must first look at the role of linear TV and its appeal to advertisers. Sports broadcasting’s whole purpose is to attract viewers and generate ad revenue. Historically, major broadcast networks were the only ones with enough capital and experience to produce and distribute sporting events. NBC broadcast the first live TV sports event in the US, a college baseball game between Columbia and Princeton in 1939.

In the following years, the appeal of live sports was so massive that one scholar stated, “Television got off the ground because of sports.” It wasn’t until 1951 that NBC, again, broadcast the first nationwide football game between Duke and Pittsburgh. NBC, CBS, and ABC continued to grapple for sports broadcasting supremacy for several more years. In 1961 ABC, the weakest of the three networks with regards to sports broadcasting rights, introduced The Wide World of Sports as a sports journalism alternative to live sporting events. This started the trend in broader sports journalism. Nearly two decades later, ESPN launched, revolutionizing sports broadcasting by creating an entire TV network dedicated to sports coverage.

All the while, a massive audience for sports broadcasting continued to materialize. By the 1990s and early 2000s, individual franchises and leagues built their own networks, such as New York’s YES Network and the Big Ten Network for the college athletic conference. Today, nearly every sports entity of consequence has a way to produce and distribute content.

I will stop the history portion there, but it’s important to see that the evolution from newspaper to radio to the arc of TV broadcasting shared above has provided decades of groundwork for a multi-billion sports media industry. Today, as enabling technologies make streaming more accessible, leagues, teams, and networks all continue to find ways to attract and maintain the lucrative sports viewing audience.

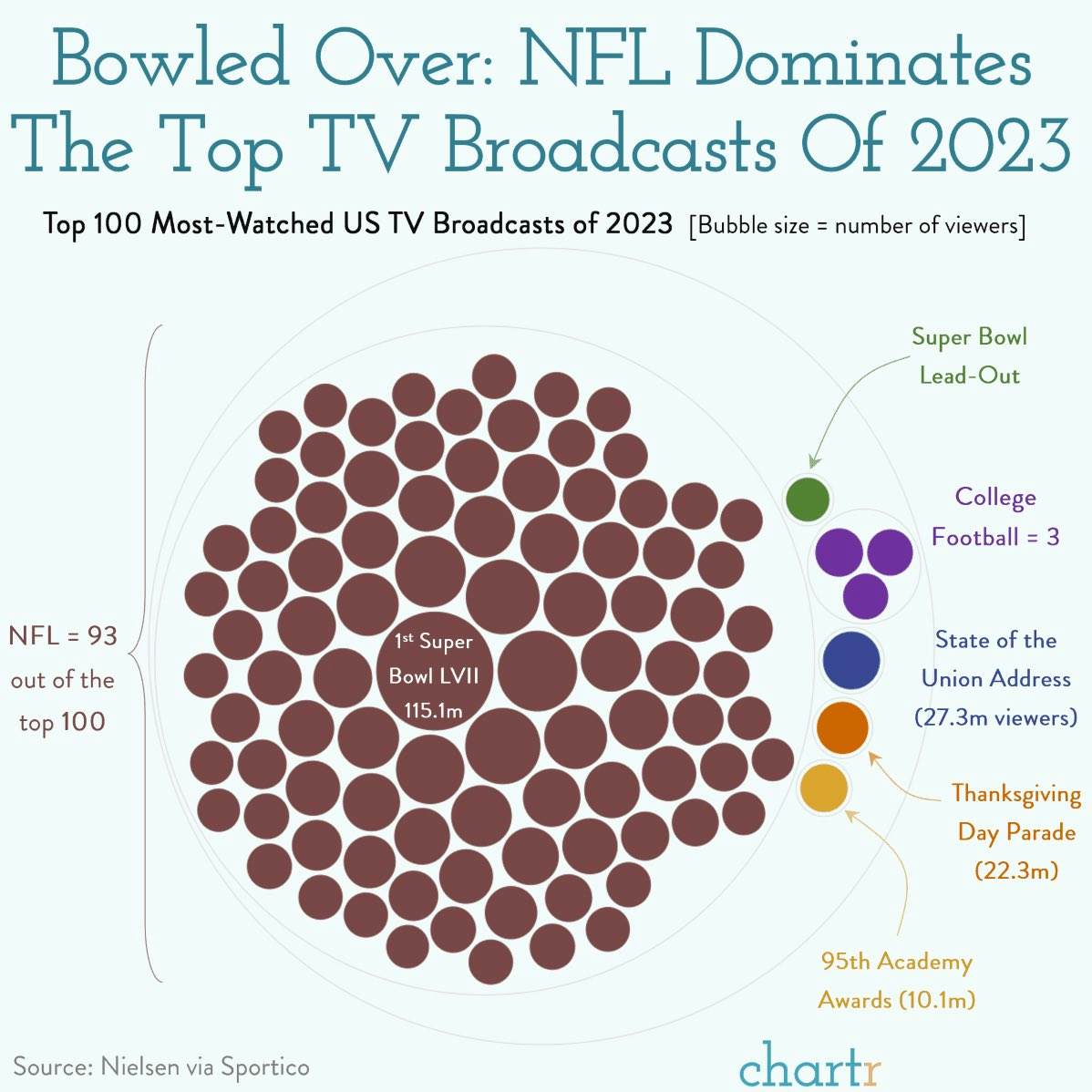

Live sports, in particular, have the ability to attract viewers because of the immediacy that is inherent in viewing events. This is so powerful that one 2022 Axios article stated that “sports is saving linear TV.” That statement is reinforced by the fact that sports media rights accounted for ~$56 billion in revenue in 2023 — the largest contributor in the industry. Another data point from Sportico shows that football games and coverage accounted for 97 of the top 100 most-viewed TV broadcasts in 2023.

The Future of Sports Media

As the sports media landscape continues to evolve, here are a few dynamics we believe will influence the future of sports media, plus some venture companies innovating in these spaces.

1. Increasing Value of Media Rights

Because live sports remain one of the most attractive assets for broadcasters, major networks continue to up the ante to acquire exclusive rights. ESPN and Turner Sports are currently nearing the end of a nine-year, $24-billion contract with the NBA. The next negotiation will likely be even larger and may approach $75 million according to some estimates.

Our sample venture company is Relo Metrics. Increased value of media rights is derived from the fact that sports are an important advertising mechanism. Relo Metrics provides rights holders and sponsors to measure and analyze the performance of different marketing strategies. Ultimately, tools like this are what help justify the growing value of sports assets.

2. New Entrants Into Sports Broadcasting

Sports have also attracted new entrants to compete with incumbents like NBC, CBS, and ESPN. For example, Amazon is reportedly paying the NFL $1 billion per season just to broadcast Thursday night games. Other streaming services are looking to acquire unique sports assets to attract and retain subscribers.

The Player’s Lounge is an Alumni Ventures’ investment. TPL does not own the rights to the live game, but does help with the creation and distribution of off-the-field ,athlete-driven content. TPL is especially important in the NIL era of college sports, where players and fans are looking to engage more directly with one another.

The Player’s Lounge is a Web 3.0 platform built to empower relationships within the collegiate sports community.

3. Complementary Platforms

As competition for broadcasting rights increases, the fact remains that delivery is still relatively concentrated. However, complementary platforms are now benefiting from sports broadcasting activity by offering content to new audiences. Over-the-top (OTT) viewing, an alternative to linear TV, is becoming increasingly common and is projected to reach $245 billion by 2028.

Canela Media, another AV investment, is an OTT streaming service for Spanish-speaking audiences. The company reaches over 50 million unique viewers and — among other things — offers sports events and coverage. Canela has established an advantage by aggregating content relevant to “sports-obsessed Latino fans” and offering its audience content that they can’t find elsewhere.

Canela Media is a digital media technology company that generates content relevant to Latino and Spanish-speaking communities.

4. Changing Consumer Preferences

Sports are inherently social viewing experiences, but where and how consumers are watching sports continues to change. Twenty years ago, a fan had to be in front of a TV at a particular time to watch a full game. Today, fans are increasingly turning to mobile and short-form video, as well as finding different ways to socialize over a game. A survey indicated that 70% of fans used social media during sporting events, illustrating that connection over sports is still important but taking place in new ways.

In the spotlight this time is a stealth startup that’s creating a new social viewing experience through a platform for live-streaming fan commentary during sports games. This need is currently being met by patching together tools like YouTube, Twitch, Twitter, and others — leaving space for an optimized fan-generated content platform.

5. Customized Content Delivery

New technology has enabled the delivery of personalized content. With that comes the opportunity for more targeted (and therefore higher value) advertising. By giving consumers the content that they want at the right time and through the correct channel, companies can improve engagement with the content.

WSC Sports, a workflow automation platform, is a great example of innovators in the space. WSC analyzes live events, identifies everything that occurs in the game, creates customized short-form video content, and publishes it to any digital destination. This enables sports media-right owners, leagues, and teams to engage their fans in new ways that optimize for the prevalence of new viewing channels.

6. Authentic and Proprietary Content

While the broadcasting rights directly associated with sports events may be owned by large players, the ability to create authentic content around sports is available to all. Platforms will be valuable if they can help facilitate the distribution of this content or help larger companies aggregate content that feels more authentic and less produced than traditional TV.

Another workflow platform, Greenfly collects media assets from fans and helps organize and deliver the assets to make them actionable. This allows leagues and teams to leverage and put to use the authentic content being created across the fan ecosystem.

Getting in the Game

Sports is likely to be one of the most valuable assets in media well into the future. For startups looking to grow in this space, it’s important to find a pain point — whether for a content owner, advertiser, league, or fan — and find ways to help address those unmet needs. There is no shortage of opportunity in this space, and our AV Sports Fund will be looking to back some of the most promising venture-backed founders across the sports media landscape.

Learn more about sports media trends and startups in our webinar. You can watch it here.

See video policy below.

This communication is from Alumni Ventures, a for-profit venture capital company that is not affiliated with or endorsed by any school. It is not personalized advice, and AV only provides advice to its client funds. This communication is neither an offer to sell, nor a solicitation of an offer to purchase, any security. Such offers are made only pursuant to the formal offering documents for the fund(s) concerned, and describe significant risks and other material information that should be carefully considered before investing. For additional information, please see here. Achievement of investment objectives, including any amount of investment return, cannot be guaranteed. Co-investors are shown for illustrative purposes only, do not reflect all organizations with which AV co-invests, and do not necessarily indicate future co-investors. Example portfolio companies shown are not available to future investors, except potentially in the case of follow-on investments. Venture capital investing involves substantial risk, including risk of loss of all capital invested. This communication includes forward-looking statements, generally consisting of any statement pertaining to any issue other than historical fact, including without limitation predictions, financial projections, the anticipated results of the execution of any plan or strategy, the expectation or belief of the speaker, or other events or circumstances to exist in the future. Forward-looking statements are not representations of actual fact, depend on certain assumptions that may not be realized, and are not guaranteed to occur. Any forward-looking statements included in this communication speak only as of the date of the communication. AV and its affiliates disclaim any obligation to update, amend, or alter such forward-looking statements, whether due to subsequent events, new information, or otherwise.